When you walk into a pharmacy with a prescription for a brand-name drug, you expect to get the cheapest option available-especially if a generic version has been approved. That’s the whole point of state substitution laws: they let pharmacists swap in a cheaper generic unless the doctor says no. But in recent years, big pharmaceutical companies have found ways to sabotage this system-not by breaking the law directly, but by gaming it. And it’s costing patients and taxpayers billions.

How Generic Substitution Is Supposed to Work

State laws in the U.S. allow pharmacists to substitute a generic drug for a brand-name one if it’s bioequivalent-meaning it works the same way in the body. These laws exist because generics are typically 80% cheaper. Once a brand-name drug’s patent expires, generics flood the market. In most cases, they capture 80 to 90% of sales within months. That’s how competition is supposed to lower prices. But here’s the catch: if the original brand-name drug disappears from shelves before generics arrive, substitution can’t happen. And that’s exactly what some companies have done.Product Hopping: The Hidden Antitrust Scheme

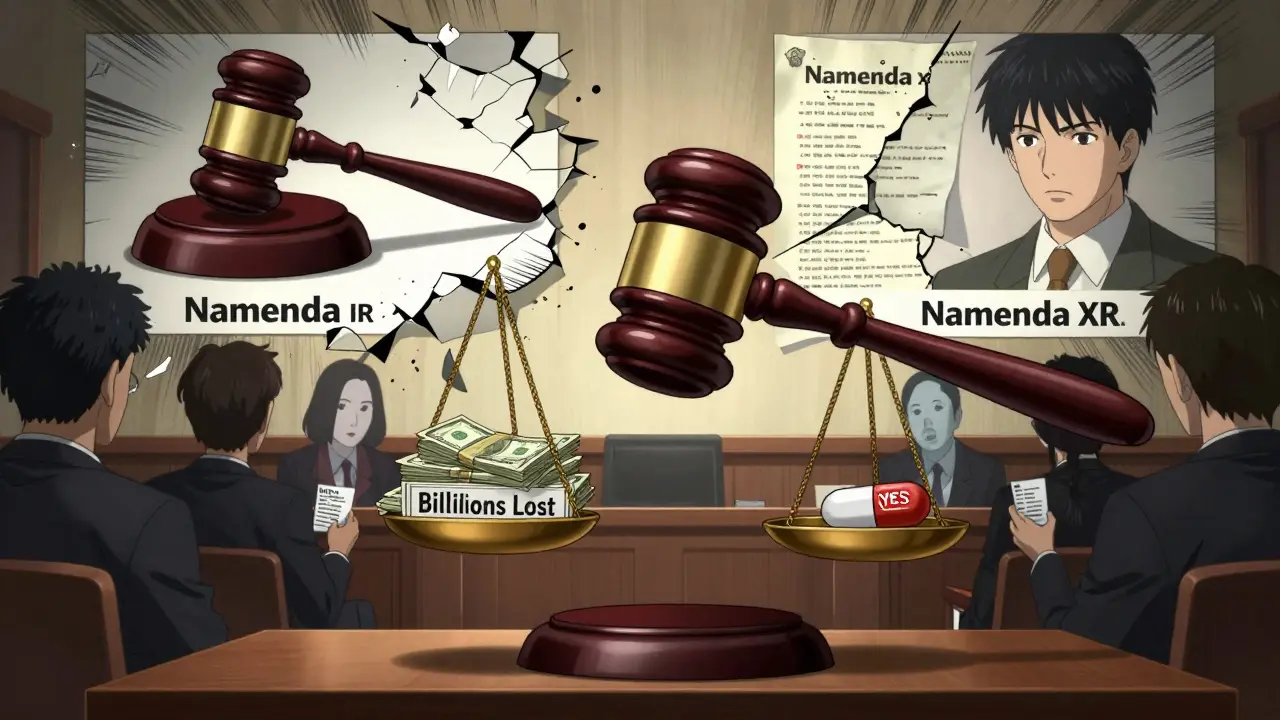

The most common tactic is called product hopping. It’s when a drugmaker introduces a slightly modified version of a drug-say, a pill that dissolves slower, or a film that sticks to the gum-while pulling the original version off the market. The new version gets a new patent, extending the company’s monopoly. But the change isn’t medically meaningful. It’s just enough to confuse patients and doctors. Take Namenda, a drug for Alzheimer’s. The original version, Namenda IR (immediate release), was due to lose patent protection. Instead of letting generics take over, the manufacturer, Actavis, introduced Namenda XR (extended release) and pulled Namenda IR from the market 30 days before generics could launch. Patients couldn’t switch back. Pharmacists couldn’t substitute. The original drug was gone. And because switching prescriptions is a hassle-doctors have to re-authorize, patients have to adjust-most stayed on the new version, even though it cost more. The Second Circuit Court of Appeals ruled in 2016 that this wasn’t innovation. It was anticompetitive. The court said Actavis had used the substitution laws as a weapon: by removing the original drug, they eliminated the only cost-efficient way for generics to compete.Why Courts Are Split on This

Not all courts see it the same way. In 2009, a court dismissed a case against AstraZeneca for switching patients from Prilosec to Nexium. Why? Because Prilosec was still available. The court saw Nexium as an added option, not a trap. The difference is simple: if the original drug stays on the market, courts often say it’s fair competition. But if it’s pulled-especially right before generics enter-it looks like sabotage. That’s why the Namenda case was a turning point. The court recognized that state substitution laws only work if the original drug is still there to be substituted. Another example: Suboxone. Reckitt Benckiser replaced Suboxone tablets with a film that stuck to the inside of the cheek. They then spread claims that the tablets were unsafe-even though there was no evidence. The FTC found this was a coercive tactic to push patients away from the tablet version, which generics could easily copy. In 2019 and 2020, the FTC forced Reckitt to settle, agreeing to stop the misleading claims.

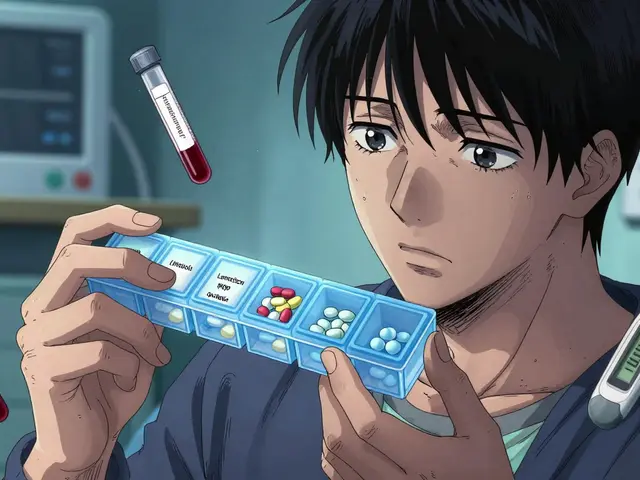

The Role of REMS and Sample Denial

It’s not just about switching formulations. Some companies block generics by abusing FDA-mandated safety programs called REMS (Risk Evaluation and Mitigation Strategies). These were designed to control dangerous drugs, like opioids or chemotherapy agents. But instead of using them for safety, some brand-name makers use REMS to deny generic manufacturers access to the drug samples they need to prove bioequivalence. Without samples, generics can’t test their products. No testing? No approval. No approval? No competition. According to a 2017 study in the Cornell Law Review, over 100 generic companies have reported being blocked from getting samples. One analysis found that restricted access to just 40 drugs cost the system more than $5 billion a year. This isn’t an accident. It’s a strategy. As legal scholar Michael A. Carrier put it: “The denial of samples fails the ‘no economic sense’ test-because it only makes sense if you’re trying to hurt your competitors.”Financial Impact: Billions Lost to Delayed Competition

The numbers are staggering. The FTC estimates that delayed generic entry through product hopping and patent manipulation costs U.S. consumers and taxpayers billions every year. For example:- Revlimid’s price jumped from $6,000 to $24,000 per month over 20 years.

- Humira, Keytruda, and Revlimid alone cost an estimated $167 billion more in the U.S. than in Europe due to delayed generics.

- Teva’s switch from Copaxone to a new formulation cost patients $4.3 to $6.5 billion over two and a half years before the patent was invalidated.

Enforcement: Who’s Fighting Back?

The FTC has been the main enforcer. After the Namenda ruling, they pushed for a preliminary injunction requiring Actavis to keep selling the old version for 30 days after generics entered. They’ve also settled cases with Reckitt and Indivior over Suboxone. In 2022, the FTC released a major report titled “Pharmaceutical Product Hopping,” laying out how these tactics undermine competition. The Department of Justice has gone further-targeting generic manufacturers themselves. In 2023, Teva paid a $225 million criminal fine for price-fixing with other generic makers. Glenmark paid $30 million. These aren’t antitrust cases against big pharma-they’re cases against the generics. It shows how complex and messy this battlefield is. State attorneys general have also stepped in. New York’s AG won an injunction against Actavis in 2014, forcing them to keep Namenda IR on the market. That case became the blueprint for future challenges.What’s Next? Legal Gaps and Legislative Pressure

There’s still no clear federal law against product hopping. Courts are inconsistent. Some see it as innovation. Others see it as fraud. That’s why the FTC is now pushing for legislative fixes. In 2023, Congress directed the FTC to investigate how patent thickets and REMS abuse delay generic entry. Experts agree: if you want real competition, you need to protect the ability of generics to enter the market. That means:- Baring drugmakers from withdrawing original products before generics launch.

- Forcing companies to provide samples to generic manufacturers under reasonable terms.

- Requiring proof of real therapeutic benefit before granting new patents for minor changes.

What This Means for You

If you or a loved one takes a chronic medication-like for high blood pressure, diabetes, or depression-this affects you. The longer it takes for generics to arrive, the longer you pay more. Insurance companies pay more. Medicare and Medicaid pay more. And eventually, those costs get passed down to you through higher premiums and taxes. You might not know it, but your pharmacist is caught in the middle. They want to give you the cheapest option. But if the original drug is gone, they can’t. And if the new version is patented, they’re stuck. The system was built to save money. Big pharma found a way to break it. And until lawmakers and regulators close the loopholes, patients will keep paying the price.What is product hopping in the pharmaceutical industry?

Product hopping is when a drugmaker replaces an expiring-patent medication with a slightly modified version-like a new dosage form or delivery method-while withdrawing the original. This prevents pharmacists from substituting cheaper generics, even when they’re approved, because the original drug is no longer available. Courts have ruled this can be anticompetitive if the change offers no real medical benefit and is timed to block generic entry.

How do state substitution laws relate to antitrust violations?

State substitution laws let pharmacists swap brand-name drugs for cheaper generics automatically. But if the brand-name drug is pulled from the market before generics arrive, those laws can’t work. Companies that withdraw the original drug to block substitution are using the law against itself. The FTC and courts have found this to be an antitrust violation because it eliminates the only low-cost way for generics to compete.

What’s the difference between Namenda and Nexium cases?

In the Namenda case, the original immediate-release version was completely withdrawn before generics could enter. The court ruled this was anticompetitive. In the Nexium case, the original drug, Prilosec, remained on the market. The court saw Nexium as a new option, not a trap. The key difference is availability: if the original drug is still there, courts usually allow the switch. If it’s gone, they often see it as sabotage.

Can generic manufacturers get the samples they need to test their drugs?

Often, no. Brand-name companies use FDA-mandated safety programs called REMS to restrict access to drug samples. Without those samples, generics can’t prove their product is bioequivalent. More than 100 generic manufacturers have reported being blocked. This tactic delays competition and can cost billions annually in higher drug prices.

What has the FTC done to stop these practices?

The FTC has filed lawsuits, secured court injunctions, and won settlements. In the Namenda case, they forced Actavis to keep selling the old version for 30 days after generics entered. In Suboxone, they settled with Reckitt Benckiser after finding deceptive claims about tablet safety. In 2022, they released a comprehensive report documenting these tactics and calling for stronger enforcement and legislative fixes.

Are there any laws specifically banning product hopping?

No federal law explicitly bans product hopping. Courts have ruled against it in some cases, like Namenda, but not in others. The FTC and some lawmakers are pushing for new legislation to clarify that withdrawing a drug solely to block generics is illegal. Until then, enforcement relies on existing antitrust laws, which were never designed for this kind of pharmaceutical maneuvering.

Comments (6)

Kevin Narvaes

so like... big pharma is just playing chess while we're stuck playing checkers? 🤡

Malvina Tomja

This is why I stopped trusting doctors. They're paid to push the expensive stuff. I don't care if it's 'slightly better'-I just want to not go broke.

shubham rathee

reminds me of how apple stopped supporting old iphones so you buy new ones lol same energy

Glenda Marínez Granados

So let me get this straight... they don't innovate, they just change the color of the pill and call it a patent? 😒 And we wonder why healthcare is a nightmare.

Amber Lane

My grandma takes a generic for blood pressure. She pays $4 a month. If they pull it, she'll choose between food and medicine. This isn't business. It's cruelty.

Andrew Rinaldi

I think the real issue isn't just the tactics-it's that our legal system still treats medicine like a commodity instead of a human right. The laws were never meant to handle this kind of corporate manipulation. We need to rethink the entire framework.