When you pick up a prescription, you might not think about why your insurance covers one version of a drug but not another. But behind every pill bottle is a complex system designed to save money-preferred generic lists are at the heart of it. These aren’t just random choices. They’re carefully built by insurance companies and pharmacy benefit managers (PBMs) to push patients toward cheaper alternatives that work just as well. And if you’re paying for meds out of pocket, understanding how these lists work can save you hundreds-or even thousands-each year.

How Preferred Generic Lists Actually Work

Insurers don’t just pick generics because they’re cheap. They pick them because they’re proven. The FDA requires every generic drug to match the brand-name version in strength, dosage, safety, and effectiveness. In fact, 98.5% of approved generics meet this standard, according to FDA research from 2021. So when your plan puts lisinopril (a generic blood pressure med) on Tier 1, it’s not a gamble-it’s a math problem.

Here’s how the system breaks down:

- Tier 1: Preferred generics - These are the cheapest. You’ll usually pay $5-$15 for a 30-day supply. Examples: metformin, atorvastatin, levothyroxine.

- Tier 2: Preferred brands and some generics - Slightly more expensive. Copays range from $25-$50. These might include drugs with fewer generic competitors.

- Tier 3: Non-preferred brands - You pay $50-$100. Insurers put these here to discourage use unless absolutely necessary.

- Tier 4: Specialty drugs - Biologics, cancer meds, rare disease treatments. Coinsurance applies-sometimes 30% or more of the cost. A single dose of Humira can run over $1,200.

Over 98% of commercial health plans and all Medicare Part D plans use this tiered structure. And in 2023, 89% of all prescriptions filled in the U.S. were for generics. That’s not because doctors are lazy-it’s because insurers built the system to make generics the default.

Why Insurers Love Preferred Generics

The numbers speak for themselves. Generic drugs cost 80-85% less than brand-name versions, according to the FDA. When six or more companies make the same generic, prices can drop by up to 95%. For example, a 30-day supply of brand-name Lipitor used to cost over $200. Now, generic atorvastatin? Around $10.

Insurers aren’t just saving money-they’re passing some of it to you. A 2022 study found that patients paid $194 less per prescription on average when using generics instead of brands. That’s not a small amount. If you take three meds a month, that’s over $700 saved annually.

But here’s the catch: insurers don’t always tell you how they make these decisions. Pharmacy Benefit Managers (PBMs)-companies like CVS Health, OptumRx, and Evernorth-negotiate rebates and discounts with drug makers. They get 25-30% off brand-name drugs, but with generics, they buy in bulk directly from manufacturers. That’s why generics are cheaper: no middlemen, no rebates, just lower wholesale prices.

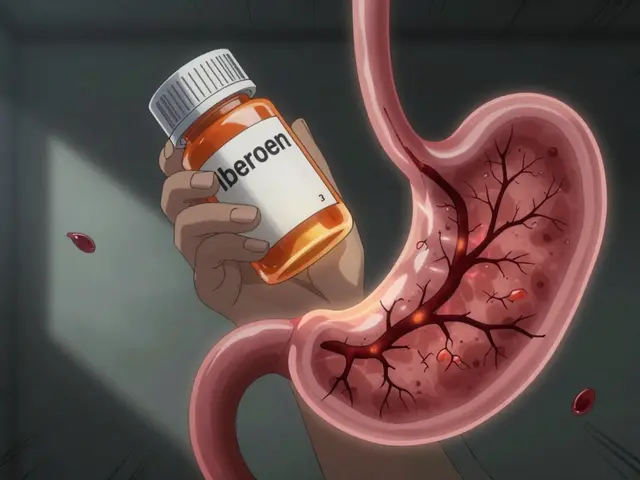

When Generics Don’t Work as Well (And Why That Matters)

Most of the time, generics are just as good. But not always.

Drugs like warfarin (a blood thinner) have a narrow therapeutic index. That means even tiny differences in how your body absorbs the drug can cause dangerous side effects. A 2022 report from the American College of Clinical Pharmacy found that 23% of doctors avoid switching patients from brand-name warfarin to generics because of stability concerns.

Then there’s the issue of biosimilars-generic versions of biologic drugs like Humira or Enbrel. These are complex proteins, not simple chemicals, so they’re harder to copy. The FDA says they’re safe, but many patients on biosimilars lose access to co-pay assistance programs. A 2023 Cigna report showed that 44% of patients switching from Humira to Amjevita (its biosimilar) ended up paying more out of pocket because the manufacturer no longer covered their copays.

And step therapy? That’s when your insurer forces you to try a cheaper drug first-even if your doctor says it won’t work. The American Medical Association found that 42% of doctors saw delays in treating chronic pain because patients had to fail on generics before getting the right med. That’s not efficiency. That’s bureaucracy.

What Patients Are Really Paying (And Why They’re Frustrated)

Reddit threads, patient forums, and surveys paint a clear picture: people love the savings, but hate the hoops.

One user, u/PharmaSaver99, cut their monthly levothyroxine cost from $187 to $12 by switching to the generic. That’s a win.

Another, u/BiologicPatient, pays $850 for Amjevita (the biosimilar to Humira) but used to pay $1,200 for the brand. Sounds good-until you realize their old plan had a $100 monthly co-pay card. The biosimilar doesn’t. So now they’re paying $750 more out of pocket than before.

GoodRx’s 2023 survey of 15,000 patients found that 76% appreciated lower costs, but 63% had to fight for prior authorization just to get a brand-name drug their doctor prescribed. And Medicare’s own survey showed that 58% of enrollees couldn’t even tell you which tier their meds were on.

It’s not that people don’t want to save money. It’s that the system is confusing, inconsistent, and sometimes cruel.

How to Navigate the System and Save Money

You don’t have to be a policy expert to get the best deal. Here’s what actually works:

- Check your formulary every year - During open enrollment, look up your meds on your plan’s formulary list. Even small changes in tier placement can cost you hundreds.

- Ask your pharmacist - In 89% of states, pharmacists can automatically swap a brand for a generic unless the doctor writes “dispense as written.” Don’t assume they will-ask.

- Use GoodRx or SingleCare - Sometimes, the cash price with a coupon is lower than your insurance copay. Always compare.

- Appeal if denied - If your insurer denies a brand-name drug your doctor says you need, 68% of appeals succeed with proper documentation. Your doctor’s note matters.

- Know your out-of-pocket max - Some insurers now use “accumulator adjuster” programs that don’t count biosimilar payments toward your annual cap. That means you might hit your max faster and pay more later.

People who spend just 45 minutes a year reviewing their formulary save an average of 32% on meds. That’s not magic. That’s awareness.

The Future of Formularies

Things are changing. In 2025, Medicare will require all Part D plans to place biosimilars in the same tier as their brand-name counterparts. That could push biosimilar use from 15% to 45% in just a few years.

UnitedHealthcare is already testing “value-based formularies”-where drugs move up or down tiers based on real-world results, not just price. If a generic works better for heart failure patients in practice, it might get promoted.

But the big question remains: will cost still drive decisions, or will outcomes? Right now, it’s still mostly about price. The U.S. spends $122.7 billion a year on generics-but only 23% of total drug spending. That means we’re buying most of our pills cheaply, but the expensive ones still drive the bill.

Insurers aren’t evil. They’re responding to a broken system where drug prices are set by market power, not value. Preferred generic lists are a smart, necessary tool. But they’re not perfect. And until we fix the root problem-how drugs are priced-patients will keep paying the price.

Why does my insurance only cover the generic version of my medication?

Insurers cover generics because they’re proven to be just as effective as brand-name drugs but cost 80-85% less. By placing generics on Tier 1, insurers reduce their own costs and often lower your out-of-pocket expenses. This system is designed to encourage the use of cost-effective treatments without sacrificing safety or quality.

Can I still get the brand-name drug if I want it?

Yes, but you’ll pay more. If your doctor prescribes a brand-name drug that’s not on your plan’s preferred list, you can request a prior authorization or appeal the decision. Many appeals (68%) are approved when your doctor provides documentation showing why the generic won’t work for you-like allergies, side effects, or lack of effectiveness.

Are generic drugs really as good as brand-name drugs?

Yes, for the vast majority of medications. The FDA requires generics to have the same active ingredients, strength, dosage form, and bioequivalence as the brand. Studies show 98.5% of generics meet this standard. The only exceptions are drugs with a narrow therapeutic index-like warfarin or certain seizure meds-where small differences in absorption can matter.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs like aspirin or metformin. Biosimilars are highly similar versions of complex biologic drugs like Humira or Enbrel, which are made from living cells. While biosimilars are cheaper, they’re not identical, and manufacturers often don’t offer co-pay assistance like brand-name makers do-leading to higher out-of-pocket costs for patients.

Why do some plans make me try a generic before covering my prescribed drug?

This is called step therapy. Insurers require you to try a cheaper, preferred drug first to control costs. While it saves money overall, it can delay treatment. The American Medical Association found that 42% of doctors report treatment delays because of step therapy, especially in chronic conditions like pain or autoimmune diseases.

How can I find out which tier my medication is on?

Log into your insurance plan’s website and search for your plan’s formulary or preferred drug list. You can also call customer service or ask your pharmacist. Medicare’s Plan Finder tool is one of the most user-friendly, scoring 4.2/5 in usability. Commercial plans? They average only 2.8/5-so you might need to dig deeper.

Do preferred generic lists affect my out-of-pocket maximum?

Sometimes. Some insurers use “accumulator adjuster” programs that don’t count the amount you pay for biosimilars or other non-preferred drugs toward your annual out-of-pocket maximum. This means you could hit your cap faster and pay more later. Always ask your insurer how payments are counted.

What You Can Do Today

Don’t wait for your next prescription to be a surprise. Open your plan’s formulary list. Look up your top three meds. Compare the copay for the generic versus the brand. Call your pharmacist and ask if they can switch your prescription automatically. Use a coupon app. If your doctor prescribed something expensive, ask: “Is there a generic or biosimilar that’s covered?”

It’s not about fighting the system. It’s about using it. The money saved isn’t just for insurers-it’s for you. And if you know how to play the game, you’ll pay less, get the right meds, and avoid the hidden costs no one tells you about.

Comments (5)

Kelly McRainey Moore

Just saved $150 this month by switching my blood pressure med to generic. No side effects, no drama. Pharmacist even gave me a free lollipop for being smart. 🍭

Amber Lane

My grandma takes 5 generics. She says, 'If it keeps me alive and lets me bake cookies, I don't care what's on the label.' Wise woman.

Ashok Sakra

THIS SYSTEM IS A JOKE. I PAY $800 A MONTH FOR MY DRUGS AND THEY SAY 'JUST USE GENERIC' BUT THE GENERIC MADE ME SICK!! I WANT MY BRAND BACK!!!

Gerard Jordan

Love this breakdown! 🙌 Just shared it with my mom who’s on Medicare. She’s gonna check her formulary tonight. You’re helping people save money AND sanity. 💙

michelle Brownsea

It’s not merely 'cost-saving'-it’s systemic coercion disguised as efficiency. The FDA’s 98.5% statistic is statistically misleading when applied to individuals with narrow therapeutic indices-yet insurers treat every patient as a data point. This isn’t healthcare. It’s actuarial exploitation with a smiley face.