Why Your Medication Copays Keep Adding Up

You’re juggling five or six prescriptions. One refill is due every other week. Some cost $10, others $50. You’re not missing doses-you’re just tired of the hassle and the bills. Every time you walk into the pharmacy, you pay again. Even if you have insurance, those copays stack up fast. A 72-year-old in Halifax with diabetes, high blood pressure, and arthritis might pay $20-$60 per visit. That’s $120 to $360 a month. Over a year? That’s $1,440 to $4,320 out of pocket-just for refills.

And it’s not just the money. Missed doses happen when you forget which med is due when. One study found medication errors go up by 32% when patients manage multiple staggered refill dates. That’s not just inconvenient-it’s dangerous.

The good news? You don’t have to keep paying like this. There’s a simple, free service most pharmacies offer that can cut your pharmacy visits in half-and your copays with them. It’s called medication synchronization.

What Is Medication Synchronization (Med Sync)?

Med sync isn’t magic. It’s a pharmacy program that lines up all your regular, long-term medications to refill on the same day each month. No more scrambling between weeks. No more paying multiple copays in one month. Instead of 12 visits a year, you make four.

This started in the early 2010s as a way to help people with chronic conditions like heart disease, diabetes, and COPD stay on track. By 2014, the American Pharmacists Association officially backed it. Today, 87% of major pharmacy chains in Canada and the U.S. offer it-including Shoppers Drug Mart, Rexall, and Pharmasave.

Here’s how it works: you pick one day each month-say, the first Tuesday. All your meds are ready then. You come in once. Pay once. Leave with everything. Your pharmacist handles the rest.

How to Get Started With Med Sync

It’s not complicated. You don’t need a doctor’s note. You don’t need to switch pharmacies. Just walk in or call your local pharmacy and ask:

- “Do you offer medication synchronization?”

- “Can you help me sync all my chronic meds?”

That’s it. The pharmacist will pull up your file, check which prescriptions are eligible, and start the process.

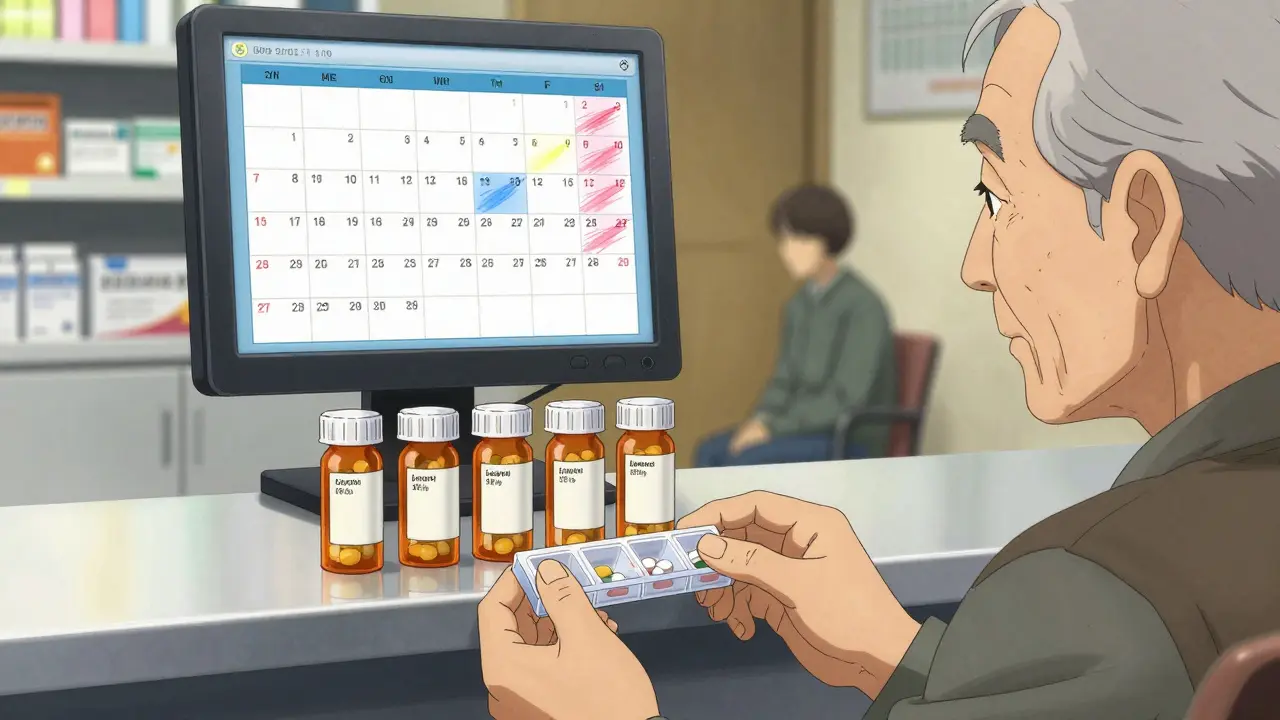

There are four steps:

- Enrollment-You sign up during a quick 15-20 minute chat with your pharmacist. No forms. No fees.

- Medication Review-They look at everything: prescriptions, over-the-counter pills, supplements. They check for duplicates or interactions.

- Short Fills-This is the tricky part. To align your dates, you might get a smaller supply of one or two meds this month. For example, if your blood pressure med usually runs 30 days but your diabetes med runs 90, they might give you 10 days now so everything lines up next month. It’s temporary.

- Monthly Pickup-After 1-3 months, all your meds are synced. You come in once a month. Done.

Some people worry about running out during the short fill phase. That’s valid. But your pharmacist will warn you. They’ll give you enough to cover the gap. If you’re nervous, ask them to schedule your sync day after a weekend or holiday so you’re never without meds over a long break.

How Med Sync Cuts Your Copays

Let’s say you take seven medications. Three are 30-day supplies. Four are 90-day. Without sync, you refill 15 times a year. That’s 15 copays.

With sync? You refill four times a year. One per month.

Even if each copay is $30, that’s $450 a year instead of $1,800. That’s $1,350 saved. And that’s just the copays. You also save on gas, bus fare, time off work, and the stress of keeping track.

Studies back this up. CMS data shows patients using med sync had 23.6% fewer hospital visits for medication-related problems between 2020 and 2022. Fewer trips to the ER means lower overall costs-not just for you, but for the system.

One Reddit user in Ontario shared: “I synced my mom’s 8 meds. Her pharmacy visits dropped from 12 to 4 a year. Saved $120 just on transportation. And she missed fewer doses-her pharmacy records showed a 40% drop.”

What Doesn’t Work With Med Sync

Med sync isn’t perfect. It doesn’t fix everything. Here’s where it hits limits:

- Acute meds-Antibiotics, painkillers, or short-term prescriptions won’t sync. They’re meant to be taken as needed.

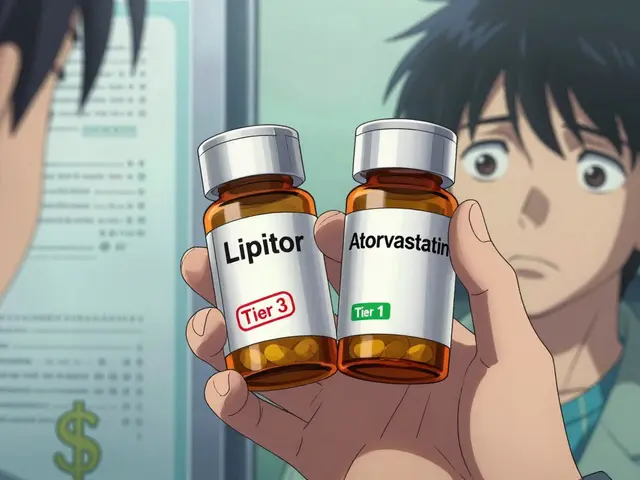

- Insurance rules-Some plans restrict early refills. Medicare Part D, for example, won’t let you refill a 30-day script until 70% is used up. That can delay sync.

- 90-day vs. 30-day mixes-If you have a 90-day statin and a 30-day blood thinner, syncing them takes extra steps. Your pharmacist might need to request an early refill exception.

- Specialty drugs-High-cost meds for conditions like rheumatoid arthritis or MS often come with manufacturer coupons. But if your insurer uses a “copay accumulator” program, those coupons don’t count toward your deductible. That means you pay more out of pocket even if you’re synced.

That last point is critical. In 2023, KFF reported that copay accumulators increased out-of-pocket costs for specialty drugs by up to 1,200% for some patients. One person in Halifax told us their $50 monthly copay jumped to $650 because their manufacturer coupon was ignored. That’s not med sync’s fault-it’s insurance policy.

Ask your pharmacist: “Does my plan use copay accumulators?” If yes, you need to know how it affects your most expensive meds. Sometimes, switching to a different manufacturer’s version or using a patient assistance program can help.

Combination Pills: The Ultimate Coordination Hack

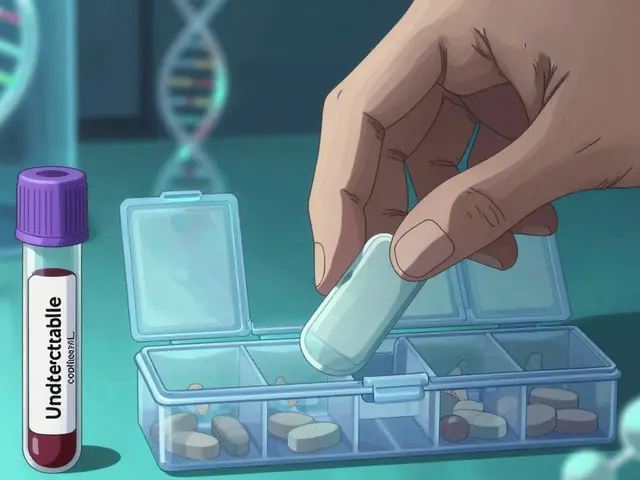

What if you could take one pill instead of three? That’s what combination medications do. They mix two or more drugs into a single tablet. For example, there are pills that combine blood pressure meds, or diabetes meds with a cholesterol drug.

Since 2018, the FDA has approved 127 new combination pills. They’re not available for every drug pair-but when they are, they’re game-changers.

MaxCareRx found that patients using combination pills missed doses 27% less often. Why? Because you’re not juggling multiple bottles. One pill, one time, one copay.

Ask your doctor: “Is there a combination pill for my meds?” If you’re on lisinopril and hydrochlorothiazide for blood pressure, there’s likely a combo. Same for metformin and sitagliptin for diabetes.

Doctors are more open to this now. A 2022 paper from the American College of Physicians said combination pills should be the first choice for patients on two or more drugs for the same condition.

What to Ask Your Pharmacist

Don’t assume they’ll bring this up. You have to ask. Here’s what to say:

- “Can you sync all my maintenance meds?”

- “Are any of my drugs available as a combination pill?”

- “Does my insurance use copay accumulators?”

- “Can you check if I’m eligible for manufacturer assistance programs?”

- “Do you offer monthly medication therapy management sessions?”

Those last sessions are gold. At Farmington Drugs, patients who attended monthly check-ins had 37% higher adherence. That’s not just about refills-it’s about making sure your meds still work, aren’t causing side effects, and aren’t interacting with each other.

What to Watch Out For

Not all pharmacies are equally good at med sync. Some do it well. Others treat it like a box-ticking exercise.

Look for these red flags:

- They say, “We don’t do that.” (Try another pharmacy.)

- They can’t tell you when your sync day will be.

- They don’t explain the short-fill phase.

- You get a refill notice for one med and not the others.

Trustpilot reviews show Walgreens’ program has 4.2/5 stars, mostly for clear communication. Shoppers Drug Mart’s version is also highly rated in Canada. If your pharmacy is vague, switch.

Also, keep your list updated. If you start a new med, tell your pharmacist immediately. If you stop one, let them know. Sync only works if your list is accurate.

What’s Changing in 2026

The rules are shifting. In 2025, the federal government proposed new rules to limit how insurers use copay accumulators. If passed, patients on specialty drugs could save an average of $1,200 a year.

Also, more pharmacies are adding digital tools. Some apps now send refill reminders and sync with your pharmacy. Sixty-three FDA-cleared apps are available now-some free, some paid. Ask your pharmacist if they recommend one.

By 2030, the Congressional Budget Office predicts med sync will be standard for 95% of chronic medication users. That’s not a guess-it’s a projection based on cost savings and adherence data.

Final Takeaway: It’s Not About Saving Money. It’s About Staying Healthy.

Med sync isn’t just a money trick. It’s a health tool. The NIH found that for every 10% increase in out-of-pocket costs, people take 2.3% fewer pills. That’s not laziness. That’s human behavior. When it’s hard, people skip.

If you’re on three or more chronic meds, med sync cuts the friction. Fewer visits. Fewer copays. Fewer mistakes. Better control.

Walk into your pharmacy this week. Ask for med sync. Take the first step. Your body-and your wallet-will thank you.